- XRP is currently at a crucial point with speculation around a major price breakout.

- Institutional investors are increasingly interested in XRP, anticipating a rise to a target of $2.77 and beyond.

- The approval of a spot XRP ETF in Brazil has heightened market interest and could be pivotal if introduced in the U.S.

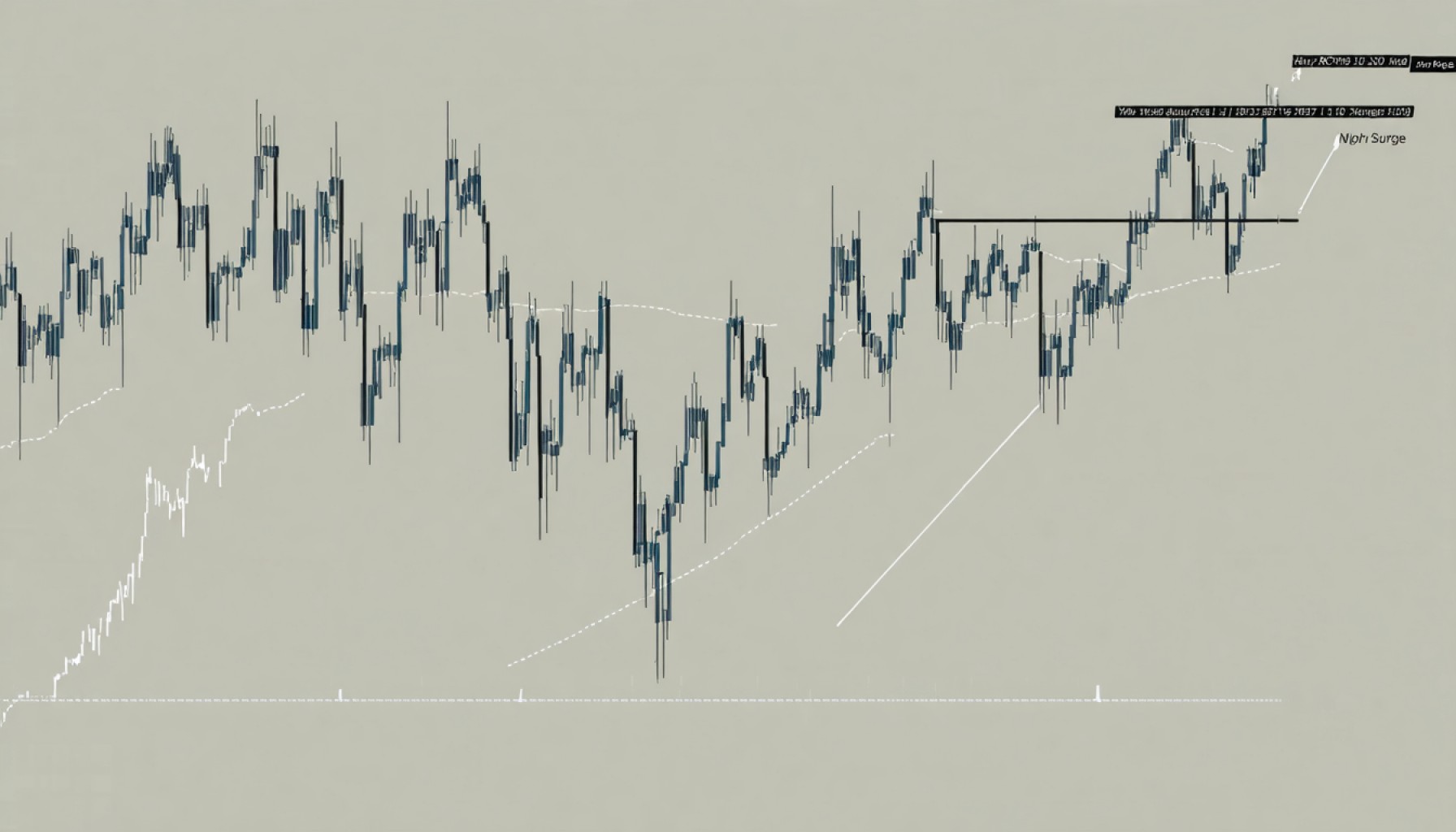

- XRP recently faced challenges breaking past a key resistance level of $2.60, necessary for reversing its downtrend from a high of $3.

- Presently trading at $2.35, XRP has seen an 18.2% decline but maintains potential due to institutional demand.

- Indicators like the Relative Strength Index show promising interest, targeting a possible future price point of $5 and long-term speculations above $60.

- The anticipated U.S. spot ETF could significantly impact market dynamics, similar to Bitcoin ETFs.

- Market participants eagerly watch XRP, questioning if it will capitalize on favorable conditions to achieve projected gains.

In a swirl of market speculation and optimism, XRP finds itself at a pivotal juncture. As waves of institutional investors pour into the crypto space, analysts speculate that the digital asset is inching closer to a significant breakout. The target in question is a tantalizing $2.77, a price point which could ignite remarkable upward momentum for the asset.

The current buzz around XRP builds upon recent advancements, including the approval of a spot XRP ETF in Brazil. This development has not gone unnoticed by market whales, who have considerably beefed up their XRP portfolios. Such moves are underpinned by ongoing discussions about similar possibilities in the United States, which could further fuel XRP’s ascent.

Yet, XRP’s journey has not been without hurdles. The digital currency recently struggled to breach a critical resistance level, causing it to falter. Crypto analysts, with an eagle-eyed view of the market, point to the $2.60 mark as a crucial threshold. Crossing this boundary could enable XRP to reclaim lost ground after sliding from a prior high of $3, driven down by broader market turbulence.

Presently, XRP trades at $2.35, marking a sharp decline of 18.2% on the day. However, the solid demand from institutional investors might spell a promising future. Key indicators such as the Relative Strength Index suggest a growing interest in XRP, underscoring a potential push towards the elusive $5 mark. Some analysts, emboldened by these signals, even project an ambitious long-term price target above $60, hinging on widespread market adoption and favorable regulatory developments.

The introduction of a spot XRP ETF in the U.S. is seen as a potential game-changer, akin to the transformative impact Bitcoin ETFs have had. As institutional appetite swells, any ETF announcement could act as a catalyst, changing the landscape overnight.

In this dynamic crypto world, all eyes are glued to XRP’s performance as it teeters on the brink of a possible breakout. The path to the predicted $5 and beyond has obstacles, but the confluence of positive market signals, strategic investments by whales, and regulatory progress could set the stage for XRP’s resurgence. As traders and enthusiasts monitor the situation, the question remains: Will XRP rise to meet its potential, or will it linger in uncertainty? The market waits with bated breath.

XRP on the Verge: Can it Breakthrough to $5?

XRP is currently a much-discussed digital asset, predominantly due to the growing interest from institutional investors and recent approvals like the spot XRP ETF in Brazil. While this sounds promising, the cryptocurrency landscape is intricate, filled with potential rewards and pitfalls. Here’s an in-depth analysis of XRP, addressing pressing questions and offering actionable insights for potential investors.

Recent Developments and Market Dynamics

1. Institutional Interest: The buzz surrounding XRP has intensified due to significant institutional investments. Institutions typically allocate resources based on long-term projections, indicating that they view XRP as a worthwhile asset.

2. ETF Approval: The Brazilian regulatory approval of a spot XRP ETF marks a significant milestone, mirroring the positive effects that Bitcoin ETFs have historically had on its prices and perceived legitimacy.

3. Current Price Position: XRP’s current trading price is $2.35, showcasing a volatility typical in crypto markets. However, this could represent a strategic entry point for investors anticipating a rise.

4. Technical Analysis Indicators: The Relative Strength Index (RSI) for XRP is a critical metric to watch. A bullish RSI can indicate potential upward movement, suggesting times when it may be prudent to buy or hold.

Prominent Questions and Concerns

– Will XRP Reach $5? Analysts are split on this prediction. While the right conditions could propel XRP towards this target, the market’s volatile nature requires cautiously optimistic expectations. Institutional backing, an ETF approval in the U.S., and favorable regulations could expedite the price increase.

– Potential for Long-term Growth: Predictions of XRP reaching above $60 reflect extreme long-term optimism rooted in widespread adoption and regulatory clarity. However, these forecasts are speculative and rely heavily on market evolution and institutional engagement.

XRP’s Challenges and Limitations

– Regulatory Hurdles: In the U.S., regulatory clarity is a significant barrier, with XRP still embroiled in legal challenges that could impact its price and general adoption.

– Market Volatility: Cryptocurrencies, including XRP, are subject to abrupt price fluctuations influenced by market sentiment, technological innovations, and macroeconomic factors.

Strategic Recommendations

– Diversify Investments: Consider XRP as part of a diversified crypto portfolio. This can help mitigate risks associated with market volatility while also capitalizing on potential gains.

– Monitor Regulatory Developments: Pay attention to news regarding XRP’s regulatory standing, particularly any updates on U.S. ETF approvals.

– Utilize Technical Analysis: Employ tools like RSI and trend analysis to determine optimal buy/sell opportunities.

– Secure Crypto Holdings: Ensure your XRP investments are stored in secure wallets to protect against hacks and unauthorized access.

Industry Trends and Predictions

– US ETF Impact: Should a spot ETF for XRP gain approval in the U.S., it is likely anticipated to bring about significant institutional influx, reminiscent of the impact Bitcoin saw with its ETF approvals.

– Technological Advancements: Beyond regulatory aspects, developments in blockchain technology that enhance scalability and transaction speed can further XRP’s growth.

For those interested in keeping a finger on the pulse of crypto and investing wisely:

Visit Ripple’s official website for more insights and updates on XRP.

Overall, XRP stands on the precipice of potentially transformative growth, driven by institutional confidence, technological potential, and regulatory developments. As an investor, staying informed and making data-driven decisions will be pivotal in navigating this evolving market landscape.